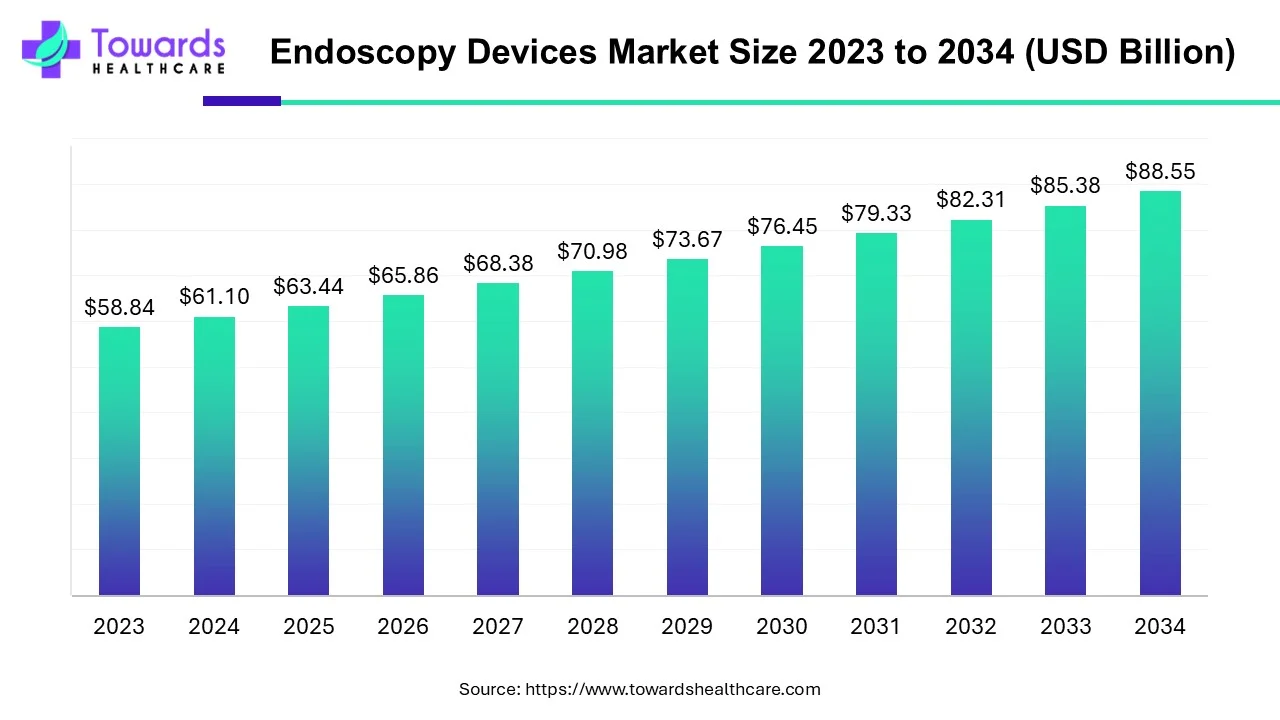

Endoscopy Devices Market Surges to USD 63.44 Billion in 2025 with Outpatient Facilities Leading End-Use Adoption

The global endoscopy devices market size is calculated at USD 63.44 billion in 2025 and is expected to reach around USD 88.55 billion by 2034, growing at a CAGR of 3.82% for the forecasted period.

Ottawa, July 11, 2025 (GLOBE NEWSWIRE) -- The global endoscopy devices market size was valued at USD 61.1 billion in 2024 and is predicted to hit around USD 88.55 billion by 2034, a study published by Towards Healthcare a sister firm of Precedence Research.

The growth of the market is driven by the growing prevalence of chronic diseases and increasing demand and adoption of minimally invasive procedures, with technological advancements driving the growth of the market.

Get a sneak peek into key trends and forecasts driving the Endoscopy Devices Market @ https://www.towardshealthcare.com/download-sample/5425

Key takeaways

- North America held the largest share of the endoscopy devices market in 2024.

- Asia-Pacific is projected to host the fastest-growing market in the coming years.

- By product, the endoscope segment held a dominant presence in the market in 2024.

- By product, the endoscopy visualization systems segment is predicted to witness significant growth in the market over the forecast period.

- By end-use, the outpatient facilities segment led the global endoscopy devices market in 2024.

- By end-use, the hospitals segment is anticipated to show lucrative growth in the market over the coming years.

Endoscopy Devices Market Overview & Potential

Endoscopy devices, often called endoscopes, are medical tools used to view the inside of the body. They usually consist of long, thin, flexible tubes with a camera and light attached at the end, inserted through natural openings such as the mouth or anus, or through small incisions. These devices help doctors examine organs and tissues for diagnosis and treatment.

Common types include gastroscopes, colonoscopes, bronchoscopes, cystoscopes, arthroscopes, duodenoscopes, and laparoscopes. Key parts of an endoscope include a light source to illuminate the area, a camera to capture images or videos, a working channel for passing instruments during biopsies or procedures, and control elements that allow the physician to steer and manipulate the device.

Access in-depth market data, segment analysis, and growth metrics for the Endoscopy Devices Market @ https://www.towardshealthcare.com/download-databook/5425

What Are the Key Growth Factors Responsible for The Growth of The Endoscopy Devices Market?

The growth of the market is driven by the growing prevalence of chronic diseases like cancer, gastrointestinal disorders, and cardiovascular diseases, which demand endoscopic procedures for early detection and management, thus fueling the growth of the market. The growth is also driven by the increasing adoption of minimally invasive procedures compared to traditional surgeries for shorter and faster recovery and to reduce the healthcare costs, supporting the growth of the market.

The technological advancements, like innovation in endoscopic equipment with enhanced techniques in high definition, along with robot-assisted endoscopy, further fuel the growth of the market and also support the expansion globally.

What are the Growing Trends Associated with the endoscopy devices market?

Minimally Invasive Surgeries

- The growing demand from patients and professionals for minimally invasive surgical procedures for faster recovery fuels the growth of the market.

Technological Advancements

- The technological advancement with the integration of AI for accurate and automated techniques for enhancing diagnosis with accuracy and efficiency fuels the growth.

Growing Incidence of Chronic Diseases

- The growing incidence of chronic diseases like cancer and cardiovascular diseases, and the need for frequent endoscopic procedures for early detection and management, fuels the growth of the market.

Rising Demand for Visualization Equipment

- The demand for visualizing equipment for accurate detection and enhancing diagnosis has increased the demand and growth of the market.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What is the key Challenge in the Endoscopy Devices Market?

The key challenge responsible for limiting the growth of the market is the high cost of advanced endoscopy devices are expensive, which also affects the adoption by many patients fur to the high cost of treatment associated, particularly with the price-sensitive patients, which hinders the growth of the market. Another factor is the maintenance and operation cost associated with it also limits the growth of the market.

Regional Analysis

How Did North America Dominate the Endoscopy Devices Market In 2024?

North America held the largest share of the market in 2024. The growth of the market in the region is driven by technological advancements, with rising investments from both the public and private sectors due to increasing chronic disease prevalence, like cancer and cardiac diseases, with a rising number of hospitals and healthcare sectors further fueling the growth of the market.

The rising aging population and technological advancements with the integration of AI to increase the accuracy and precision for early diagnosis of disease, increase the demand and growth of the market, supporting the expansion of the market in the region.

Endoscopy device usage is rising in the U.S. due to increasing gastrointestinal disorders, an aging population, and a preference for minimally invasive procedures. Technological advancements, improved diagnostics, and outpatient care growth contribute to demand. Enhanced awareness, early disease detection, and healthcare accessibility further support widespread adoption across hospitals and ambulatory surgical centers nationwide.

Canada is seeing rising usage of endoscopy devices due to advances in minimally invasive procedures and a growing preference for outpatient care. Disposable endoscopes and high-definition visualization systems are increasingly adopted. The shift toward patient-centered, cost-effective healthcare drives broader use, with outpatient facilities performing most procedures nationwide.

- According to Volza's Global Export data, the world shipped out 7,966 Endoscopic Instrument shipments from October 2023 to September 2024 (TTM). These exports were handled by 740 world exporters to 794 buyers, showing a growth rate of 4% over the previous 12 months.

- Globally, Germany, the United States, and India are the top three exporters of Endoscopic instruments. Germany is the global leader in Endoscopic instrument exports with 7,282 shipments, followed closely by the United States with 5,542 shipments, and India in third place with 4,856 shipments.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

What Made Asia Pacific Significantly Grow in the Endoscopy Devices Market In 2024?

Asia-Pacific is projected to host the fastest-growing market in the coming years. The growth of the market is driven by growing and heavy investments for the growth of the market by the public as well as private sectors under government policies like Make in India and Made in China initiatives for domestic growth and adoption, which drives the growth of the market. The growing investments of the government and initiatives for higher adoption with infrastructure development, along with other investors for the enhancement of technology and innovation, fuel the growth and expansion of the market in the region.

China's rising use of endoscopy devices is driven by factors such as the increasing prevalence of chronic diseases, advancements in medical technology, and the growing demand for minimally invasive procedures. These developments contribute to enhanced diagnostic capabilities and improved patient outcomes.

Rising gastrointestinal diseases, technological advancements like high-definition imaging and robotics, government screening programs, and expanding healthcare infrastructure drive India’s growing endoscopy device usage. Patients and providers prefer minimally invasive procedures for faster recovery. Increased awareness and accessibility, especially in smaller cities, further boost adoption nationwide, improving diagnostics and treatment outcomes.

Segmental Insights

By product

How did endoscopy segment dominate the endoscopy market in 2024?

The endoscope segment held a dominant presence in the endoscopy devices market in 2024. The growth of the market is driven by the availability of innovative and a wide range of options with properties like flexibility, rigidity, and disposability properties driving the growth of the market. The technological advancements for the development of advanced and innovative procedures and equipment for precise and accurate diagnosis and treatment for improving the safety and effectiveness of the procedure and technique further fuel the growth of the market.

The growing advancement for the development of durable and lightweight equipment and increasing demand from the medical organizations further fuel the growth and expansion of the market.

The endoscopy visualization systems segment is predicted to witness significant growth in the endoscopy devices market over the forecast period. The growth of the market is driven by the growing demand for visualization of organs and other parts for accurate diagnosis and for proper detection through visualization equipment like camera heads, insufflators, light sources, monitors, printers, and video processors with high-definition equipment, which fuels the growth of the market.

This also helps personalized care for the treatment of diseases and for the diagnosis of specific diseases with accuracy, which fuels the growth of the market, supporting the expansion.

Elevate your healthcare strategy with Towards Healthcare. Enhance efficiency and drive better outcomes schedule a call today: https://www.towardshealthcare.com/schedule-meeting

By end-use

Which end-use segment dominates the endoscopy devices market in 2024?

The outpatient facilities segment led the global market in 2024. Outpatient facilities represent a significant and rapidly growing segment in the endoscopy device market. These settings include ambulatory surgical centers (ASCs) and specialized clinics that focus on minimally invasive procedures, allowing patients to return home the same day. The demand for endoscopy devices in outpatient facilities is driven by the increasing preference for cost-effective and efficient healthcare solutions, shorter recovery times, and reduced hospital-associated infection risks.

Technological advancements, such as compact, portable, and user-friendly endoscopic systems, further support this trend. As healthcare systems strive to reduce overall treatment costs and improve patient experiences, outpatient facilities continue to adopt advanced endoscopy devices extensively.

The hospitals segment is anticipated to show lucrative growth in the endoscopy devices market over the coming years. Hospitals remain the growing end-use segment in the endoscopy device market, accounting for a substantial share due to their extensive infrastructure and advanced capabilities. Hospitals perform a high volume of complex diagnostic and therapeutic procedures that require sophisticated endoscopic equipment, including gastrointestinal, urological, gynecological, and respiratory examinations.

The availability of skilled healthcare professionals, integrated operating rooms, and emergency care services further supports widespread endoscopy adoption in these settings. Additionally, hospitals often serve as referral centers for complicated cases, reinforcing the need for high-quality, versatile endoscopic systems. As a result, hospitals continue to drive significant demand and technological innovation in this market.

Recent Developments in the Endoscopy Devices Market

- In December 2024, in India’s rapidly growing weight loss market, medical device manufacturer Boston Scientific is poised to make a strong entry with the introduction of its Endoscopic Sleeve Gastroplasty (ESG) and Intragastric Balloon System (IBS). These advanced solutions, supported by Apollo for ESG and Orbera365 for IBS, aim to address the rising demand for minimally invasive, effective weight loss interventions.

- In December 2024, AIG Hospitals introduced PillBot™, a cutting-edge, remote-controlled (robotic) disposable endoscopy capsule technology developed by U.S.-based medical innovator Endiatx. This advanced capsule allows doctors to navigate and examine the gastrointestinal tract with precision and minimal invasiveness. The launch marks a significant step toward the future of non-invasive diagnostics, showcasing AIG Hospitals’ commitment to pioneering advanced medical technologies.

Top Companies and Their Contributions to the Endoscopy Devices Market

| Company | Contributions and Offerings |

| Activ Surgical | Innovates AI-powered imaging for enhanced surgical visualization and real-time analytics, improving precision in endoscopy. |

| Aesculap, Inc. | Offers advanced endoscopic instruments and surgical systems, focusing on minimally invasive procedures and quality tools. |

| Auris Health | Develops robotic endoscopy platforms like Monarch® for improved lung diagnostics with enhanced navigation and control. |

| Boston Scientific | Provides comprehensive endoscopy devices, including imaging systems, biopsy tools, and therapeutic instruments. |

| Conmed Corporation | Supplies versatile endoscopic equipment and energy devices supporting various surgical applications and patient safety. |

| C.R. Bard, Inc. | Known for innovative endoscopic accessories and minimally invasive solutions, improving patient outcomes and procedure ease. |

| Fujifilm Holdings | Delivers high-resolution imaging systems and diagnostic endoscopes, enhancing clarity and early disease detection. |

| Hologic | Specializes in women’s health endoscopy solutions, particularly in gynecological diagnostics and treatments. |

| Karl Storz | Offers a broad range of rigid and flexible endoscopes and video systems, emphasizing precision and ergonomic design. |

| Medtronic plc | Provides advanced endoscopic surgical devices and integrated solutions for multiple specialties, enhancing workflow efficiency. |

Browse More Insights of Towards Healthcare:

Pain Management Devices Market

The pain management devices market is valued at USD 7.68 billion in 2024, expected to grow to USD 8.41 billion in 2025, and reach approximately USD 19.1 billion by 2034, expanding at a CAGR of 9.54%.

Connected Drug Delivery Devices Market

The connected drug delivery devices market is projected to grow from USD 7.44 billion in 2024 to USD 9.18 billion in 2025, and surge to about USD 61.08 billion by 2034, with a strong CAGR of 23.44%.

Needle-Free Drug Delivery Devices Market

The needle-free drug delivery devices market is estimated at USD 14.24 billion in 2024, growing to USD 15.32 billion in 2025, and expected to hit USD 29.54 billion by 2034, at a CAGR of 7.54%.

Orthopedic Devices Market

The orthopedic devices market stands at USD 63.06 billion in 2024, is projected to reach USD 65.8 billion in 2025, and grow to around USD 96.45 billion by 2034, with a CAGR of 4.34%.

Congenital Heart Defect Devices Market

The congenital heart defect devices market is valued at USD 2.75 billion in 2024, expected to grow to USD 2.91 billion in 2025, and reach USD 4.81 billion by 2034, with a CAGR of 5.74%.

Medical Device CRO Market

The medical device CRO (Contract Research Organization) market is estimated at USD 8.49 billion in 2024, growing to USD 9.25 billion in 2025, and projected to hit USD 19.9 billion by 2034, expanding at a CAGR of 8.98%.

Neurovascular Devices Market

The neurovascular devices market is worth USD 7.37 billion in 2024, expected to grow to USD 7.8 billion in 2025, and reach around USD 12.94 billion by 2034, with a CAGR of 5.79%.

Sleep Apnea Devices Market

The sleep apnea devices market is valued at USD 4.82 billion in 2024, set to grow to USD 5.12 billion in 2025, and projected to reach USD 8.82 billion by 2034, expanding at a CAGR of 6.24%.

Automated Suturing Devices Market

The automated suturing devices market is estimated at USD 3.94 billion in 2024, expected to reach USD 4.23 billion in 2025, and grow to around USD 7.98 billion by 2034, with a CAGR of 7.34%.

Neurostimulation Devices Market

The neurostimulation devices market stands at USD 7.19 billion in 2024, is projected to reach USD 8.1 billion in 2025, and surge to USD 23.24 billion by 2034, with a robust CAGR of 12.84%.

3D Printed Medical Devices Market

The 3D printed medical devices market is forecasted to grow from USD 5.59 billion in 2025 to USD 24.69 billion by 2034, showing strong growth with a CAGR of 17.94%, driven by increasing demand for personalized healthcare solutions.

Top Key Players in the Endoscopy Devices Market

- Activ Surgical

- Aesculap, Inc.

- Auris Health

- Boston Scientific Corporation

- Conmed Corporation

- C.R. Bard, Inc.

- Fujifilm Holdings

- Hologic

- Karl Storz

- Medtronic plc

- Olympus Corporation

- Pentax Medical

- Smith & Nephew

- Stryker Corporation

Segments Covered in the Report

By Product

- Endoscope

- Reusable Endoscopes

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cytoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Pharyngoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Gastrointestinal Endoscopes

- Gastroscope (Upper GI Endoscope)

- Enteroscope

- Sigmoidoscope

- Duodenoscope

- Flexible Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cytoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Pharyngoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Gastrointestinal Endoscopes

- Gastroscope (Upper GI Endoscope)

- Enteroscope

- Sigmoidoscope

- Duodenoscope

- Colonoscope

- Capsule Endoscopes

- Robot-Assisted Endoscopes

- Rigid Endoscopes

- Disposable Endoscopes

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cytoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Pharyngoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Gastrointestinal Endoscopes

- Gastroscope (Upper GI Endoscope)

- Enteroscope

- Sigmoidoscope

- Duodenoscope

- Colonoscope

- Reusable Endoscopes

- Endoscopy Visualization Systems (Reusable Endoscopy Visualization Systems)

- Standard Definition (SD) Visualization Systems

- 2D Systems

- 3D Systems

- High Definition (HD) Visualization Systems

- 2D Systems

- 3D Systems

- Standard Definition (SD) Visualization Systems

- Endoscopy Visualization Components

- Reusable Endoscopy Visualization Components

- Camera Heads

- Insufflators

- Light Sources

- High-Definition Monitors

- Suction Pumps

- Video Processors

- Disposable Endoscopy Visualization Components

- Camera Heads

- Insufflators

- Light Sources

- Suction Pumps

- Reusable Endoscopy Visualization Components

- Operative Devices

- Reusable Operative Devices

- Energy Systems

- Access Devices

- Suction & Irrigation Systems

- Hand Instruments

- Wound Retractors

- Snares

- Disposable Operative Devices

- Energy Systems

- Access Devices

- Suction & Irrigation Systems

- Hand Instruments

- Wound Retractors

- Snares

- Reusable Operative Devices

By End-Use

- Hospitals

- Outpatient Facilities

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Access the complete Endoscopy Devices Market report with detailed insights, competitive landscape, and strategic outlook @ https://www.towardshealthcare.com/price/5425

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.