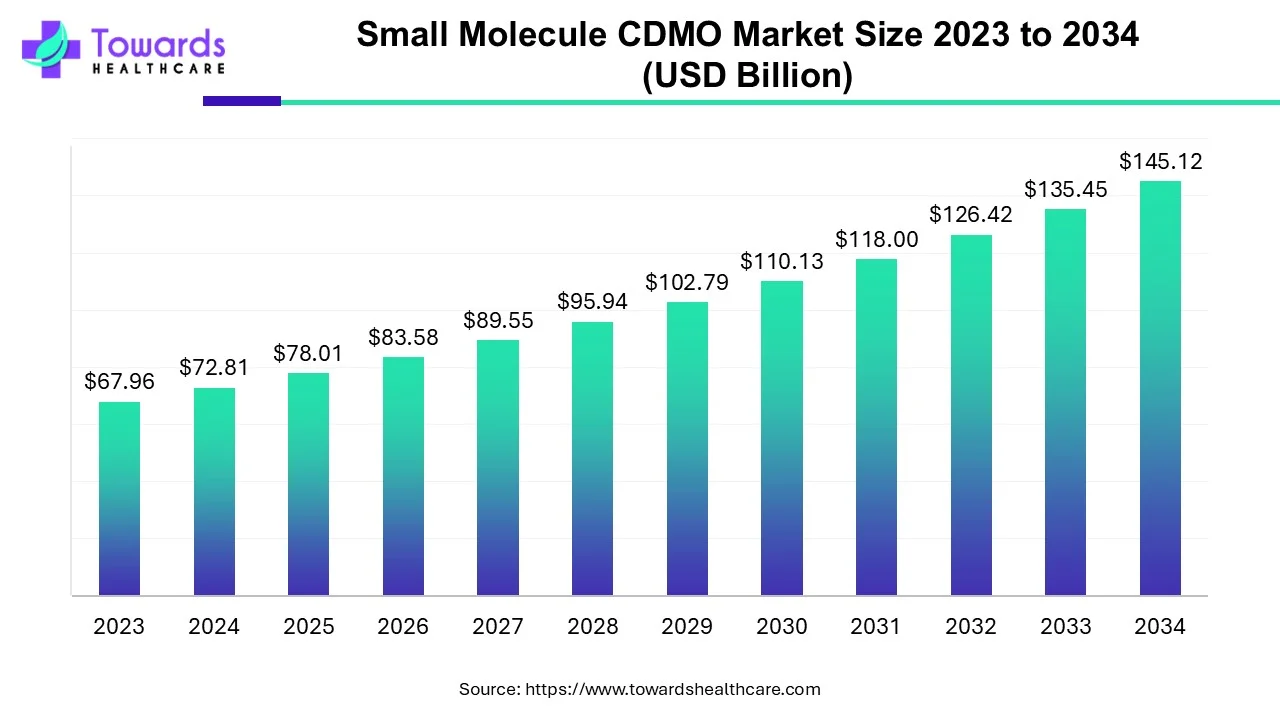

Small Molecule CDMO Market Size to Drive USD 145.12 Billion by 2034

The small molecule CDMO market is projected to grow from USD 78.01 billion in 2025 to USD 145.12 billion by 2034, registering a CAGR of 7.14%.

Ottawa, Sept. 19, 2025 (GLOBE NEWSWIRE) -- According to a study by Towards Healthcare, a sister company of Precedence Research, the global small molecule CDMO market was valued at USD 72.81 billion in 2024 and is expected to reach USD 145.12 billion by 2034, growing at a CAGR of 7.14%.

Accelerating chronic diseases and widespread demand for generic drugs are fueling the global market expansion.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5458

Key Takeaways

- North America dominated the market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during 2025-2034.

- By product, the active pharmaceutical ingredients (API) segment led the small molecule CDMO market in 2024.

- By product, the finished drug products segment is expected to grow notably in the studied years.

- By drug type, the innovators segment was dominant in the market in 2024.

- By drug type, the generics segment is expected to witness the fastest growth during 2025-2034.

- By application, the oncology segment registered dominance in the market in 2024.

- By application, the autoimmune/inflammation segment is expected to grow significantly in the upcoming years.

Market Overview & Potential

The global small molecule CDMO market consists of specialized companies that manage all stages of the development and production of small-molecule drugs for pharmaceutical clients. This further offers trained expertise, facilities, and technology for partners. These CDMOs are currently emphasizing the transformation of precision medicine, green chemistry for sustainability, and expanding end-to-end services merged in strategic alliances instead of just manufacturers. Additionally, Process Analytical Technology (PAT) and real-time release testing (RTRT) are supporting to optimization consistency, and digital tools, such as AI-enabled modeling and digital twins improve processes and accelerate tech transfer.

What are the Major Drivers in the Small Molecule CDMO Market?

The globe is facing a huge burden of chronic concerns, which are boosting the development of novel small molecules. Along with this, several biotech and virtual pharma companies are experiencing a shortage of in-house manufacturing and R&D capabilities, which further generates a vital demand for CDMO services. A rise in complications of new drug candidates, particularly highly potent small molecules, expands the requirements for specialized production facilities and well-trained professionals that are offered by CDMOs.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Drifts in the Small Molecule CDMO Market?

The widespread CDMOs are contributing their immense investments in the progressing GMP facilities, and other facilities involved in the API and biologics production.

- In June 2025, Swiss CDMO Carbogen AMCIS accelerated its ADC production capabilities with $31m investment.

- In March 2025, HAS Healthcare Advanced Synthesis SA, a leading international developer and producer of active pharmaceutical ingredients (APIs), high-potency active pharmaceutical ingredients (HPAPIs), and anticancer compounds, acquired Cerbios-Pharma SA to create a leading international Group in the CDMO sector.

- In July 2024, Navin Molecular, an Indian-headquartered CDMO with small molecule development and manufacturing capabilities, invested Rs 288 Crore (approximately €32.6 million/$35 million) to construct a 9,000 m2 GMP manufacturing plant in Dewas, India.

What is the Arising Challenge in the Market?

The global small molecule CDMO market has been facing hurdles in the protection of sensitive proprietary information, which greatly fuels demand for strong belief, clear legal frameworks, and effective security measures. Alongside, the impact of worldwide events and regional political factors on the accessibility and expense of essential raw materials results in production delays and influences timelines.

Regional Analysis

Why did North America Dominate the Market in 2024?

North America’s small molecule CDMO market captured the dominant revenue share in 2024. The combination of factors, such as the presence of robust pharmaceutical R&D, a strong regulatory framework, a well-developed outsourcing infrastructure, and the expanding demand for complex therapies, such as those for oncology and rare diseases, is supporting the regional market growth. Nowadays, ongoing acquisitions are being employed to achieve capabilities, likewise Cambrex's acquisition of Snapdragon Chemistry for flow chemistry expertise.

For instance,

- In May 2025, Radyus Research, a U.S.-based drug development organization, and Eurofins CDMO Alphora, a Canadian contract development and manufacturing organization, partnered to boost early-stage drug development for biotech companies worldwide.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

How did the Asia Pacific Grow Significantly in the Market in 2024?

In the upcoming era, the Asia Pacific is predicted to expand rapidly in the small molecule CDMO market. Specifically, China and India are facilitating a competitive benefit through low labor expenditures and a large manufacturing capacity for Active Pharmaceutical Ingredients (APIs). Moreover, the continuous breakthroughs in drug delivery approaches and the expansion of complex, specialized therapies are driving the need for accurate manufacturing processes, thus accelerating partnerships among leading pharmaceutical companies and CDMOs that comprise these specialized technical and regulatory capabilities.

For this market,

- In June 2025, Porton Advanced Solutions, a global significant cell and gene therapy CDMO service provider, and EVA Pharma, one of the leading pharmaceutical companies, signed a Memorandum of Understanding (MOU) on developing and strengthening CAR T-cell therapy development and manufacturing capabilities at EVA Pharma’s facilities.

Segmental Insights

By product analysis

Which Product Segment Led the Small Molecule CDMO Market in 2024?

The active pharmaceutical ingredients (API) segment held the dominating share of the market in 2024. The segment is driven by a rise in demand for high-potency APIs in oncology, immunology, and hormonal therapies are demanding specialized containment and production infrastructure from CDMO. Furthermore, the fostering demand for outsourced manufacturing, complex biologics, and affordable solutions for both branded and generic drugs is also supporting the broader adoption of APIs. Involvement of green chemistry principles and waste reduction plans is strengthening the sustainability of API manufacturing.

Whereas the finished drug products segment is anticipated to expand at a lucrative CAGR. The growing demand for controlled-release formulations, aseptic filling, and packaging is supporting the requirements for CDMOs in the robust further processes. Besides this, the emerging demand for diverse injectables is driving CDMOs to escalate their fill-finish services and cold chain offerings to meet the increasing market need. The application of AI and ML for process improvement, predictive analytics, and boosting effectiveness in drug development and manufacturing timelines from CDMO is fueling the global market growth.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By drug type analysis

Why did the Innovators Segment Dominate the Market in 2024?

The innovators segment held a major share of the small molecule CDMO market in 2024. The globe is focusing on advanced therapies, especially biologics and personalized medicine, further integrated with AI/ML for enhancement, demonstrating sustainable manufacturing, and accelerating into strategic partnerships for end-to-end support from R&D to commercialization are impacting the development of innovators. Moreover, certain innovations in monoclonal antibodies, CAR-T cell therapies, and antibody-drug conjugates are transforming the production facilities of CDMO.

On the other hand, the generics segment is estimated to register rapid expansion in the coming years. Across the world, the expiration of patents for blockbuster small molecule drugs, wider demand for inexpensive, accessible therapeutics are generating opportunities for generic manufacturers and their CDMO alliances to develop high-volume, and affordable drugs. In the production of generics, CDMOs are assisting in the establishment and optimization of existing drugs, along with introducing value-added generic medicines, bolstering them to stay competitive and meet developing patient needs.

By application analysis

What Made the Oncology Segment Dominant in the Market in 2024?

In the global small molecule CDMO market, the oncology segment accounted for the biggest share in 2024. Primarily, a huge usage of highly potent active pharmaceutical ingredients (HPAPIs) in oncology drugs is fostering the need for specialized containment, well-developed synthetic routes, and accurate quality control that are facilitated by CDMOs. Alongside, the emergence of the "one-stop shop" is coupled with CDMOs offering comprehensive services, which encompass early-stage drug discovery, formulation development, regulatory support, and commercial packaging.

And, the autoimmune/inflammation segment is anticipated to expand notably. Nowadays, novel approaches in the progressing nanomedicine, where CDMOs are offering nanomaterials, including polymeric nanoparticles (PLGA) and liposomes for targeted drug delivery, support improving efficiency and lowering systemic side effects in diseases, mainly rheumatoid arthritis and inflammatory bowel disease (IBD). Moreover, CDMOs emphasize the production of biologic drugs that target specific cytokines (like IL-17, IL-23), immune cells (e.g., anti-CD20 antibodies), or receptors.

Recent Developments in the Small Molecule CDMO Market

- In September 2025, BioFactura, Inc., a clinical-stage biopharmaceutical company based in Frederick, Maryland, introduced Capitol Biologics, a new Contract Development and Manufacturing Organization (CDMO) division, to simplify the development of biologic therapies.

- In June 2025, Samsung Biologics, a leading contract development and manufacturing organization (CDMO), launched Samsung Organoids, an advanced drug screening service to support clients in drug discovery and development.

- In March 2025, Raichur-based Shilpa Medicare unveiled its new full-service ‘hybrid’ contract development and manufacturing organisation (CDMO) with capabilities spanning small and large molecules and peptides.

Browse More Insights of Towards Healthcare:

Viral Vector-Based Cell & Gene Therapy CDMO Market Trends Ahead

Antibiotic CDMO Market 2025 Analysis Beta - Lactams Dominate, Sterile Injectables to Surge

Life Science CDMO Market Growth 2025 to AI Integration

Veterinary CRO and CDMO Market 2025 Asia-Pacific Leads Fastest Growth

mRNA Therapeutics CDMO Market Growth Driven by AI Integration and Clinical Expansion – 2025 Insights

CDMO Services for Pharma and Biotech Market Leads North America with 44.1% in 2024

CDMO Aseptic Filling Solutions Market Trends, Growth and Innovations

Active Pharmaceutical Ingredients CDMO Market Size & Trends in CDMO Partnerships

Oligonucleotide CDMO Market Accelerating Drug Discovery and Delivery

Topical Drugs CDMO Market Enhancing and Optimizing Drug Delivery

Cell and Gene Therapy CDMO Market Innovating Biopharmaceuticals & Services

Biologics CDMO Market Size, Trends, Innovations and Strategies

Europe Pharmaceutical CDMO Market Size, Trends & Applications

Key Players List

- Lonza

- Catalent, Inc

- Thermo Fisher Scientific Inc.

- Cambrex Corporation

- Bellen Chemistry

- Siegfried Holding AG

- Recipharm AB

- Eurofins Scientific

- Aurigene Pharmaceutical Services Ltd.

- CordenPharma International

Segments Covered in The Report

By Product

- Active Pharmaceutical Ingredients (API)

- Finished Drug Products

By Drug Type

- Innovators

- Generics

By Application

- Oncology

- Autoimmune/Inflammation

- Cardiovascular Disease

- Central Nervous System (CNS) Conditions

- Others

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5458

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.